How to Choose a Tax Preparer It’s the time of the year when you may need to choose a tax preparer to help file a tax return. You should choose your tax return preparer wisely. This is because ultimately YOU are responsible for all the information on your income tax...

Beware of Fake Tax Bills regarding ACA

The Internal Revenue Service recently issued a warning to taxpayers and tax professionals that scam artists are now sending fake tax bills regarding the Affordable Care Act (ACA). Taxpayers have reported to the IRS that scammers are sending a fake version of a CP2000...

Arrest of IRS Phone Scammers

Authorities have announced the arrest of IRS phone scammers. In the past week over a hundred scammers were arrested by authorities around the world for pretending to be IRS agents collecting individual tax liabilities. It turns out the liabilities were fabricated...

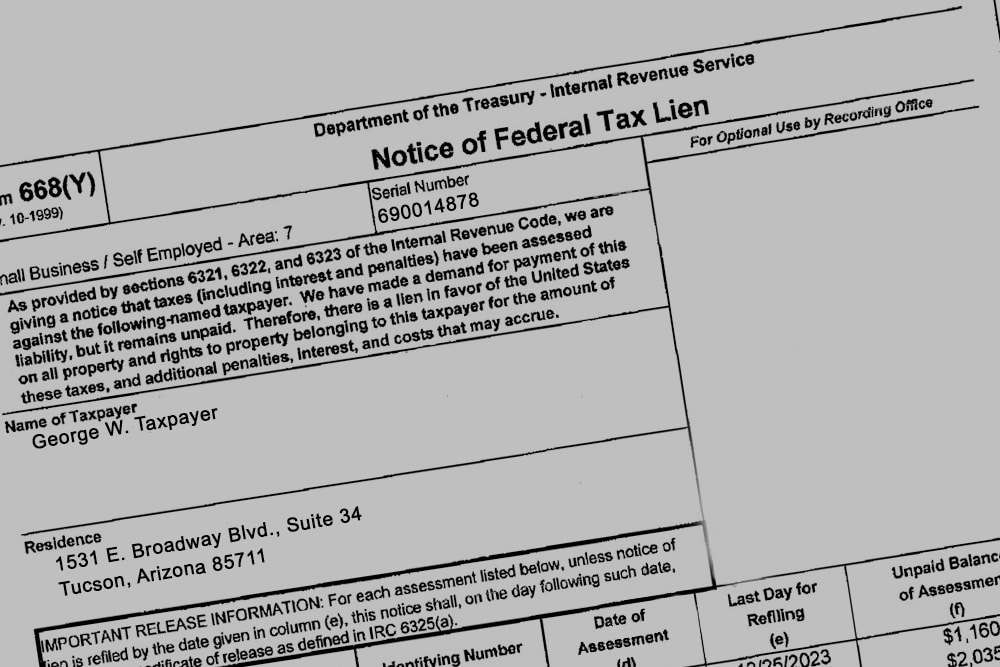

Notice of Filing of Tax Lien (NFTL)

It goes by a rather awkward acronym – NFTL - Notice of Filing of Tax Lien. If you owe the IRS money and, after their demand you have not paid it then you are subject to getting a lien filed against you. But what does this really mean? How does a lien work and how...

Will Compromise Stop Garnishment?

Will an offer in compromise stop a garnishment on your wages or the levy of your bank accounts? It is a question that comes up often. The answer can be found both in federal tax law and in tax regulations written by the department of the treasury. Under federal tax...

The Current Bankruptcy Code

The current Bankruptcy Code is a very complex set of rules, many of which are poorly drafted and difficult to understand and apply, even for bankruptcy lawyers and judges. The Internal Revenue Code, considerably longer than the bankruptcy code has long been the...

Final Notice of Intent to Levy

“Final Notice of Intent to Levy” the letter says in bold font. It arrived today via certified mail in an official looking envelope indicating it is from the Internal Revenue Service. Not good news. You have successfully ignored all the other letters you have received...

Can They Really Reduce My Tax Debt?

Harry Jones has not filed his federal tax return since 1999. When he finally got around to filing in 2007, his tax debt with penalties and interest was over $100,000. He called one of those late night TV tax relief companies who promised to reduce his debt “up to...

Good News and Bad News About Your Back Taxes

There is some good news and bad news here. The good news is that you are not alone. You are in the company of thousands of Americans who have, for whatever reason, failed to file returns for multiple years. The IRS refers to these taxpayers as chronic non-filers. The...

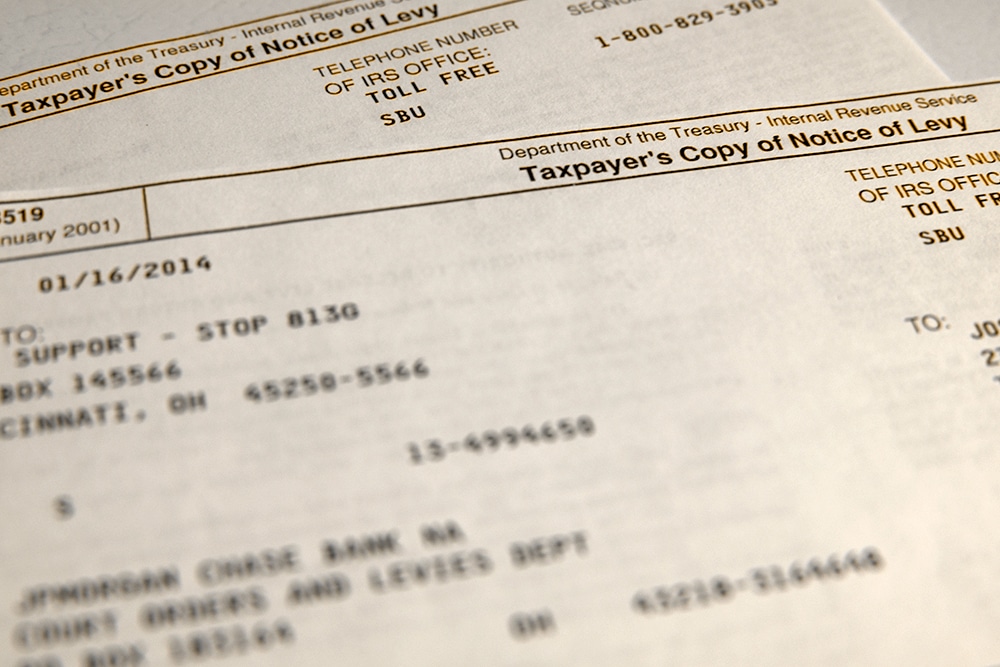

Tax Levy Information

Federal Tax Levy For taxpayers in serious debt to the IRS, the most feared weapon in the IRS arsenal is the tax levy. Using the powers granted to it in the Internal Revenue Code, the IRS can levy upon wages, bank accounts, social security payments, accounts...