by Art Weiss | Oct 29, 2016 | Uncategorized

New Jan. 31 Deadline for Employers

Under The Protecting Americans from Tax Hikes (PATH) Act, employers must now file copies of Form W-2, to the Social Security Administration, by Jan. 31. The new Jan. 31 filing deadline also applies to certain Forms 1099-MISC reporting non-employee compensation such as payments to independent contractors. In the past, employers typically had until the end of February, if filing on paper, or the end of March, if filing electronically, to submit their copies of these forms. In addition, there are changes in requesting an extension to file the Form W-2. Only one 30-day extension to file Form W-2 is available and this extension is not automatic. If an extension is necessary, a Form 8809 Application for Extension of Time to File Information Returns must be completed as soon as you know an extension is necessary, but by January 31. Please carefully review the instructions for Form 8809, for more information. “As tax season approaches, the IRS wants to be sure employers, especially smaller businesses, are aware of these new deadlines,” said IRS Commissioner John Koskinen. “We are working with the payroll community and other partners to share this information widely.” The new accelerated deadline will help the IRS improve its efforts to spot errors on returns filed by taxpayers. Having these W-2s and 1099s earlier will make it easier for the IRS to verify the legitimacy of tax returns and properly issue refunds to taxpayers eligible to receive them. In many instances, this will enable the IRS to release tax refunds more quickly than in the past. The Jan. 31 deadline has long applied to employers furnishing copies of these forms to their employees and that date remains unchanged.

Employers must be vigilant and meet these filing deadlines as the penalties for failure to do so are very steep and the IRS is unforgiving in this area. If your business has employees then make sure that your accounting and bookkeeping staff is aware of the new changes so that you avoid penalties for failing to comply with the new law.

by Art Weiss | Oct 29, 2016 | Legal Advice, Legal Issues, Personal Taxes

The Internal Revenue Service recently issued a warning to taxpayers and tax professionals that scam artists are now sending fake tax bills regarding the Affordable Care Act (ACA). Taxpayers have reported to the IRS that scammers are sending a fake version of a CP2000 notice for tax year 2015. The Treasury Inspector General for Tax Administration is now aware of the fake tax bills scam and issued advice to the public. The matter is under continuing investigation. This comes after widespread arrests of phone scammers around the world. New scams pop up all the time and the public must be vigilant about sending money or providing confidential information to someone on the phone. Everyone is a potential victim. If you are unsure whether you owe money, or if the letter you receive just does not look right, then call the IRS at 1-800 829-1040. A legitimate revenue officer will help. In the meantime, the IRS issues the advice below. For more information go to https://www.irs.gov/uac/beware-of-fake-irs-tax-bill-notices.

This scam may arrive by email, as an attachment, or by mail. It has many signs of being a fake:

- The CP2000 notices appear to be issued from an Austin, Texas, address;

- The letter says the issue is related to the Affordable Care Act and requests information regarding 2014 coverage;

- The payment voucher lists the letter number as 105C;

- Requests checks made out to I.R.S. and sent to the “Austin Processing Center” at a post office box.

by Art Weiss | Oct 29, 2016 | Personal Taxes

Authorities have announced the arrest of IRS phone scammers. In the past week over a hundred scammers were arrested by authorities around the world for pretending to be IRS agents collecting individual tax liabilities. It turns out the liabilities were fabricated and the scam artists were simply calling everyone in the phone book. While the scam was well known within the tax world, the general population was unaware of it and lost hundreds of millions of dollars. After years of successful operations, the authorities finally made wide scale arrests and tried to shut this scam down. While this is a step in the right direction, there are many more copy cats out there still making the same calls. Anyone with a telephone is a potential victim and should be aware of the scam tactics as well as the legitimate tactics that the IRS uses to contact and collect tax debts. The IRS has well established procedures for collecting debts and they do not involve calling and demanding immediate payment at the threat of impending arrests. The agents do not use scare tactics and they always provide their identification, telephone number and badge number. Finally, if you owe the IRS or if you have not filed in many years, you will receive correspondence with a telephone number to call. If you are unsure whether you owe money or not simply call the IRS at 1-800-829-1040. You will be on hold for awhile, but you will eventually speak to a legitimate revenue officer who can help. The scammers know just enough to sound very threatening and intimidating. If you are unsure whether you owe money or whether you should send them money, simply hang up and call the number above. Do not become a victim to this horrible scam!

by Art Weiss | Mar 5, 2016 | Business Taxes, Personal Taxes

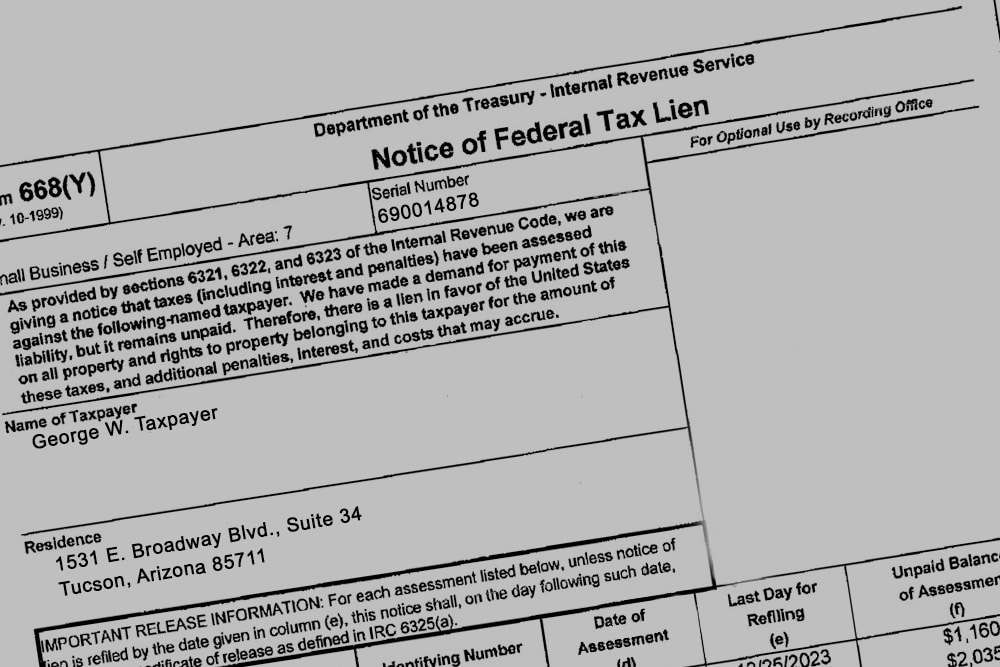

It goes by a rather awkward acronym – NFTL – Notice of Filing of Tax Lien. If you owe the IRS money and, after their demand you have not paid it then you are subject to getting a lien filed against you. But what does this really mean? How does a lien work and how does it affect you? These questions will be answered in this article.

The first thing you should know is that a lien is a “security” device, not a “collection” device. A lien collects nothing. It is merely the IRS’s way of telling the world that you are in debt to them. It established the IRS’s position in line in front of other creditors who file their liens later than the IRS. The lien, filed in the your county recorder’s office, will generally sit for years without you even knowing about it. Of course the IRS is required by law to notify you of the lien within five days of the filing. However, if you do not open the IRS letter, you may never know about it. That is until you decide to sell your house, buy a house, buy a car, borrow from a credit union or take out life or property insurance The lien will affect all of these transactions, negatively. With a lien on file against you, it will be difficult to get a car loan or house mortgage, your insurance premiums may rise and the credit union may not lend you any money (unless it is to pay off the IRS debt).

The lien will affect all of your property and rights to property. If you are due to inherit a lot of money, the IRS will assert its lien and attempt to pay your tax debt out of the inherited funds. If you sell your house, the IRS will want to be paid from the proceeds of the sale. In fact, you will not be able to sell it without a large chunk of the equity going to the IRS.

Tax relief companies often suggest they can get the lien removed. There are only a few ways the lien can get removed and none of them involve the smooth negotiation skills of these scam artists. You can pay off the debt, you can file a payment bond (a promise to pay sort of) or you can ask the IRS to subordinate the lien so that you can borrow money for your business or sell your home to pay off the debt. However other than these measures, the lien is going to stay and it will continue to affect you and your credit.

Will an offer in compromise affect a tax lien? No. Filing an offer in compromise will not have any affect on the tax lien. However, if the IRS accepts your offer and you pay the amount of the offer in full then the IRS will remove the lien. Will an installment agreement affect a tax lien? No. You can certainly enter into an agreement to pay off your tax liability over time, but the IRS will not remove the lien until the amount that you owe is paid in full. Will being declared uncollectible affect a tax lien? No. The lien will remain even if the IRS declares you uncollectible and stops all collection action. Does the IRS have to file a lien before they garnish your wages or empty your bank account? No. They can garnish your wages and empty your account without a lien in place. They do need to send you a notice of intent to levy, but this has nothing to do with the tax lien.

Avoiding a tax lien – Your best course of action if you owe money is to avoid the filing of a tax lien in the first place. (Of course if you received a NFTL then it is too late) Remember that it costs money and takes time to file a tax lien. The IRS will only do so when it determines that a lien is necessary to protect its position against other creditors (people you owe money to). If the IRS has not filed a lien already then you must take steps to make sure that you communicate with the IRS and demonstrate that you are serious about solving your tax problem. This will not guarantee that they will not file a lien, however it reduces the chances.

Arthur Weiss, Esquire

Law Office of Arthur Weiss, P.C.

2135 Grant Rd.

Tucson, AZ 85719

520-319-1124

https://artweisslaw.com

by Art Weiss | Mar 5, 2016 | Business Taxes, Offers in Compromise, Personal Taxes

Will an offer in compromise stop a garnishment on your wages or the levy of your bank accounts? It is a question that comes up often. The answer can be found both in federal tax law and in tax regulations written by the department of the treasury.

Under federal tax regulations – and I am quoting here – “The IRS will not levy against the property or rights to property of a taxpayer who submits an offer to compromise during the period the offer is pending.”

Once the IRS decides that your offer is processable, that it includes all the paperwork and forms properly filled out, then it must stop levy actions under section 6331 of the Internal Revenue Code. However, if the offer is missing documents or forms, the IRS can return it to you as un-processable and can then levy or garnish your property.

Once the IRS fully evaluates and accepts your offer it will not levy your property but you will, of course, be expected to live up to the terms of your offer.

If your offer is declined, you have thirty days to appeal that decision under federal law. The good news is that the IRS will not levy your property during that thirty day period. Also, if your original offer is declined and you make a good faith revision to that offer then the IRS will not levy during the period that the revised offer is pending. However, if the IRS decides that an offer is not in good faith but that you are sending them just to cause delay, they will immediately return the offer to you and can then levy your property at any time.

It is important that any offer you make to resolve your tax debt be made in good faith and one that you intend to honor fully and completely. If you do so, you can eliminate the debt and stop any levy activity against you. It will take effort, commitment and persistence, but if you are serious and want to reclaim your life, you can do it.

Law Office of Arthur Weiss, P.C.

2135 Grant Rd.

Tucson, AZ 85719

520-319-1124

https://artweisslaw.com